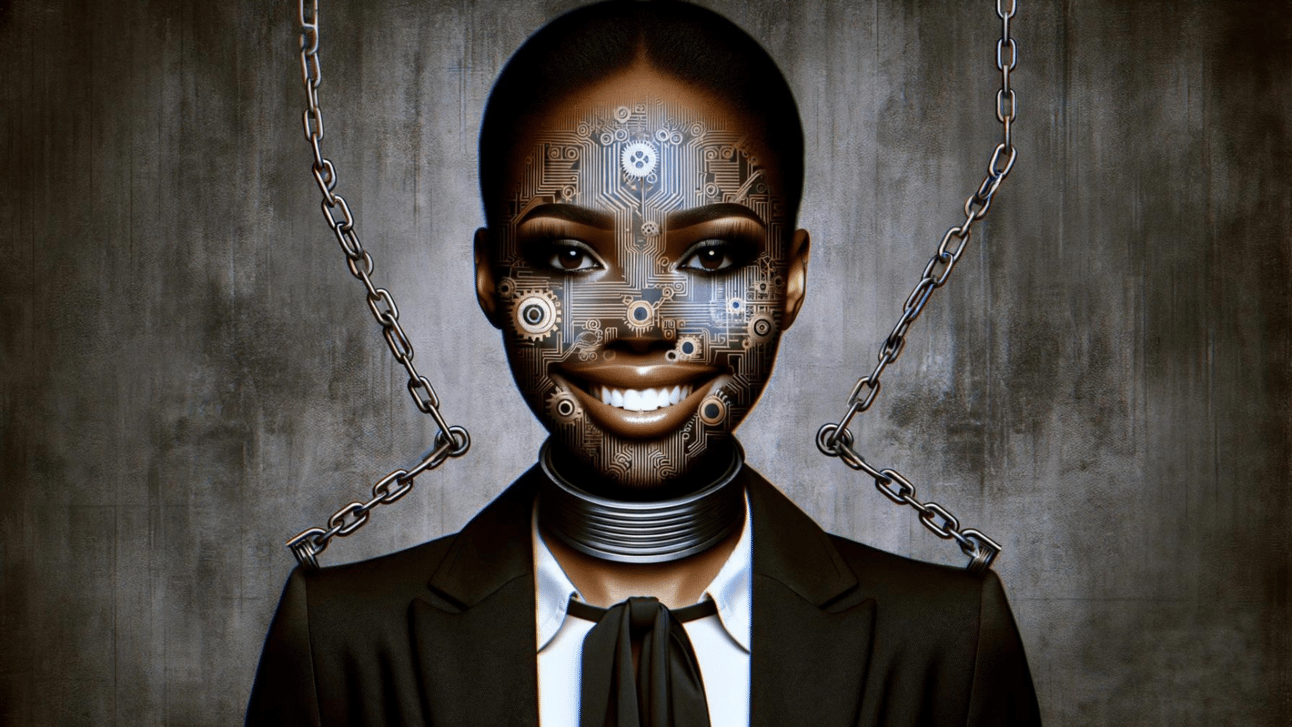

Stylized portrait of a Black woman in corporate attire with a forced smile overlaid with circuitry patterns.

The "Smile" Tax: How Marginalised Folks Pay for Your Comfort

Bridging the Gap in Corporate Diversity Initiatives

Diversity and inclusion are central to modern business strategies. Yet, research indicates a significant challenge: marginalized employees in the UK often feel compelled to conform to rigid workplace norms. This "Smile Tax"—the emotional and psychological strain of fitting in—leads to burnout and missed opportunities. For example, studies highlight the health impacts of unstable employment conditions on marginalised groups, suggesting similar pressures across corporate environments (Rodriguez, 2002); (Parrott, 2009). These findings underline the urgent need for genuinely inclusive practices that alleviate these hidden burdens and foster a supportive corporate culture.

Understanding the "Smile" Tax:

The "Smile" Tax manifests in the everyday adjustments marginalized employees must make—masking their accents, suppressing their cultural mannerisms, or always appearing cheerful and agreeable, even when facing microaggressions. Code-switching, the practice of altering communication and behaviour to fit a dominant culture, also exemplifies the "Smile" Tax" in action.

This is an image depicting a diverse group in a workplace. One person representing marginalized identities appears subdued or isolated compared to their smiling and engaged colleagues.

Impact on Marginalized Employees:

"The constant need to conform creates a mental and emotional burden that leaves no room for authenticity."

The emotional toll of continuous conformity is significant. It contributes to higher stress levels, burnout, and feelings of imposter syndrome. It robs companies of the unique perspectives and innovation that marginalized employees could offer if they felt free to be authentic.

These percentages are illustrative and based on a general understanding of the emotional impacts of code-switching. They reflect the shared emotional experiences reported by individuals who regularly switch languages in their communications.

Corporate Leadership's Role:

HR professionals, DEEI leaders, and CEOs are crucial in recognizing and addressing the "Smile" Tax.

________________________________________

Strategies for Mitigation:

Inclusive Policies: Go beyond surface-level diversity training and re-examine policies from hiring to performance reviews for potential unconscious biases that reinforce the need for conformity.

Key Tips for Policy Revision

1. Implement Bias Training for Decision-Makers: Ensure everyone involved in hiring and performance evaluations is trained to recognise and mitigate unconscious biases.

2. Regular Policy Audits: Conduct annual reviews of all HR policies to ensure they support diversity and not inadvertently pressure employees to conform.

3. Transparent Feedback Mechanisms: Establish straightforward, accessible ways for employees to provide feedback on diversity policies and their implementation.

Authentic Workplaces: Create a culture where employees feel encouraged to bring their unique perspectives. Active sponsorship programs pairing marginalized employees with senior-level sponsors can open new avenues for visibility and growth.

Enhanced Engagement Initiatives

• Cultural Competence Workshops: Facilitate workshops that educate employees on different cultures and encourage open dialogue about diversity.

• Mentorship and Sponsorship: Develop robust mentorship programs that pair employees from diverse backgrounds with leaders who can provide guidance, support, and advocacy.

• Recognition of Diverse Contributions: Regularly acknowledge and celebrate the varied cultural contributions of employees, helping to affirm the value of diverse perspectives.

Call to Action:

Take Action: Share this article with your network to raise awareness of the "Smile" Tax.

Remember: Companies that embrace authenticity outperform those that don't.

Conclusion

Addressing the "Smile" Tax isn't just an ethical imperative – it's an intelligent business strategy. Companies that create a culture where everyone feels free to be themselves gain a competitive edge. They unlock innovation, boost employee satisfaction, and ultimately, outperform those who don't.

Author Bio

I am Jarell Bempong, a therapist, coach, and passionate advocate for cultural consciousness in the workplace and beyond. My experience as a Black, gay, dyslexic English-Ghanaian informs my work, fueling my drive to break down barriers and promote true inclusivity. I'm the bestselling author of pivotal works in this field and a vanguard in utilizing AI and technology to enhance therapeutic and corporate frameworks.

Call to Action

This conversation is just the beginning. Did this article resonate with you? What steps is your organization taking to combat the "Smile" Tax? Share your experiences below. Let's learn from each other and drive real change. Together, we can build workplaces where authenticity and innovation thrive.